With the economy evolving so quickly, FintechZoom highlights the major changes affecting finance in the 2025 report. It explains the leading trends that an analysis found, including digital banking, controlling inflation, AI integration, and ESG investing.

The Economic Landscape in 2025

Now that the world is recovering from the pandemic, 2025 promises major changes for the world’s economies. Practices in the financial world are being altered by the influence of technology, regulations and the way people spend.

Recently, FintechZoom shared its Economy Report: Key Trends in 2025 to show the most important economic influences. Researchers have shown which forces are driving changes and new developments within sectors such as AI in finance and green investments.

Here, I present FintechZoom’s key viewpoints and provide useful insights for action and future hindsight. If you are involved in investments, business or have a say in policies, it is very important to keep track of these emerging trends.

Digital Banking Continues to Surge

According to the report, digital banking has become the new norm. Digital-only banks or neobanks will reach 75% of the global consumer market in 2025.

What’s driving this growth?

- Mobile-first consumers: Gen Z and Millennials prefer app-based banking.

- Lower fees: Digital banks offer competitive rates and fewer hidden charges.

- Tech innovation: Real-time payments, AI-based customer service, and smart budgeting tools enhance user experience.

Using APIs and embedded finance is leading to success for many banks. Traditional institutions are facing challenges in adopting new strategies, or they may soon be left behind.

Every organization needs to embrace digital transformation. For banks and financial companies to remain important, they should enhance user experience and rely on advanced cloud systems.

Inflation Management & Interest Rate Stabilization

The high inflation seen early in the 2020s led banks to raise interest rates. In 2025, central banks, according to FintechZoom, will be making different financial decisions. Many economies are seeing CPI gradually stabilize between 2 and 3 percent.

Highlights from the report:

- The current policy set by the U.S. Federal Reserve focuses on how the labor market and wages are faring.

- The ECB is paying close attention and ensuring that prices and growth report as expected.

- Emerging markets have improved by focusing on reducing inflation and making their currency stronger.

Bond and mortgage investors want to know what is happening, since they expect interest rates to stabilize or decrease steadily.

In other words, the period of increased volatility is becoming less severe. A predictable monetary policy allows businesses and families to make better forecasts.

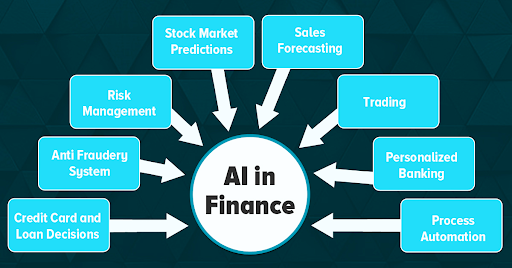

AI and Automation in Financial Services

In a few years, AI will have a significant impact on financial institutions’ activities. In recent years, 60% of leading banks have turned to AI to assist with discovering fraud, assessing levels of risk and handling customer service.

Major developments include:

- Robo-advisors: Sophisticated AI platforms offer tailored investment advice with minimal human intervention.

- Algorithmic trading: High-frequency trading powered by machine learning is growing in hedge funds.

- Chatbots and virtual assistants: These reduce operational costs while improving response times

People are paying particular attention to how AI complies with ethical standards. In the U.S., the UK, and the EU, various regulators are setting up systems for regulating AI.

Simply put, using AI properly results in better results for all three parties.

ESG and Sustainable Finance Go Mainstream

ESG investing is no longer exclusive to only a few investors. By 2025, FintechZoom predicts that nearly half of the world’s institutional investment decisions will take ESG factors under consideration.

Why the shift?

- Consumer pressure: Gen Z and Millennials prioritize sustainability.

- Regulatory incentives: The EU’s Sustainable Finance Disclosure Regulation (SFDR) is shaping global standards.

- Risk management: ESG-aligned portfolios show greater long-term resilience.

Businesses that focus on ESG are drawing more investors and strengthening their relationships with stakeholders.

Reminder: Managing ESG concerns is vital for a business. Firms should ensure that their efforts to be sustainable also help their profitability.

The Rise of Central Bank Digital Currencies (CBDCs)

Countries are now using digital coins to reform the way money is supplied. FintechZoom observes that 130 countries are planning to test or experiment with CBDCs in 2025.

Key players:

- China: The digital yuan leads with a wide domestic rollout.

- UK: The “Digital Pound” is in advanced trial stages.

- U.S.: A digital dollar remains in exploratory phases, focusing on privacy and security.

CBDCs bring about speed in transactions, less fraud and increase the number of people who can use financial services. Nonetheless, challenges such as privacy and scalability are holding blockchain back.

CBDCs could change the way people perform transactions. Financial players should be ready to bring blockchain technologies into their daily operations.

Cryptocurrency Regulation Tightens

The chaotic period of crypto is becoming under control. The FintechZoom research indicates that as a result of the market chaos in 2021–2023, regulations will get stricter by 2025.

Regulatory shifts include:

- Stablecoin rules: U.S. Treasury proposes audit requirements and reserve backing mandates.

- Exchange oversight: Platforms face licensing demands and stronger KYC/AML enforcement.

- Tax reporting: Governments are requiring full disclosure on crypto gains and losses

More institutions are embracing crypto, with the main areas being diversifying their assets and utilizing blockchain-based smart contracts.

Regulation is ensuring that cryptocurrencies are safer to use and less volatile. Those who manage their operations over a long period should ensure they are compliant and transparent.

Fintech Collaboration Over Competition

Fintechs are collaborating with banks instead of taking their place. The report from FintechZoom outlines the trend toward more cooperation rather than disruption in the industry.

Examples include:

- Open banking APIs: Allow banks and fintech apps to share customer data securely.

- Buy Now, Pay Later (BNPL): Fintechs like Klarna and Affirm partner with banks to manage risk and expand reach.

- Cross-border payments: Fintech firms help banks reduce fees and speed up transfers

The co-created partnership makes it easier for legacy institutions to provide innovative goods and services and keep their customers’ trust.

Partnering with others is gaining significance in dealing with the many issues we face. More companies will pursue collaborations, service acquisitions, and blend their brands in financial services.

Global Economic Power Shifts

Geopolitical conflicts, bringing supply chains back to where they began and new partnerships are having an impact on where the world’s economies are growing. The report indicates that Asia is on the rise, Europe is steady and the U.S. is facing political instability.

Highlights:

- India is now the world’s fastest-growing major economy.

- Southeast Asia sees a fintech and e-commerce boom.

- Africa is attracting fintech investments via mobile banking platforms like M-Pesa

In 2025, economic activity will be influenced by agreements like RCEP and other regional organizations.

People investing should explore non-traditional markets. It is emerging economies that provide growth and bring about new ideas.

Conclusion: Preparing for a Resilient Economic Future

The Economy Report 2025 highlights the current situation and outlines possible solutions. It is clear from these insights that today, it’s necessary to prioritize technology, sustainability and teamwork.

In order to thrive in the new times:

- Embrace digital transformation.

- Monitor inflation and policy shifts.

- Use AI ethically.

- Prioritize ESG.

- Adapt to regulatory changes.

As a business manager or someone who deals with their finances, you must be informed about these trends since they could affect finances by 2025.

FAQs

How rapidly is fintech growing?

Fintech is increasing faster than 20% per year and by 2027, its value around the world is predicted to be more than $400 billion.

Which areas are fintech companies expected to focus on in the future?

AI in finance, blockchain, ESG investing, open banking and digital currencies are the coming trends for the near future.

How does the use of fintech regulate the country’s economic development?

Fintech contributes to economic growth in a country by offering a better approach to finance, distangling banking workflows and presenting useful products and services.